Brahma Accounts & DeFi State: January 2024 Report

Jan 26, 2024

2 mins

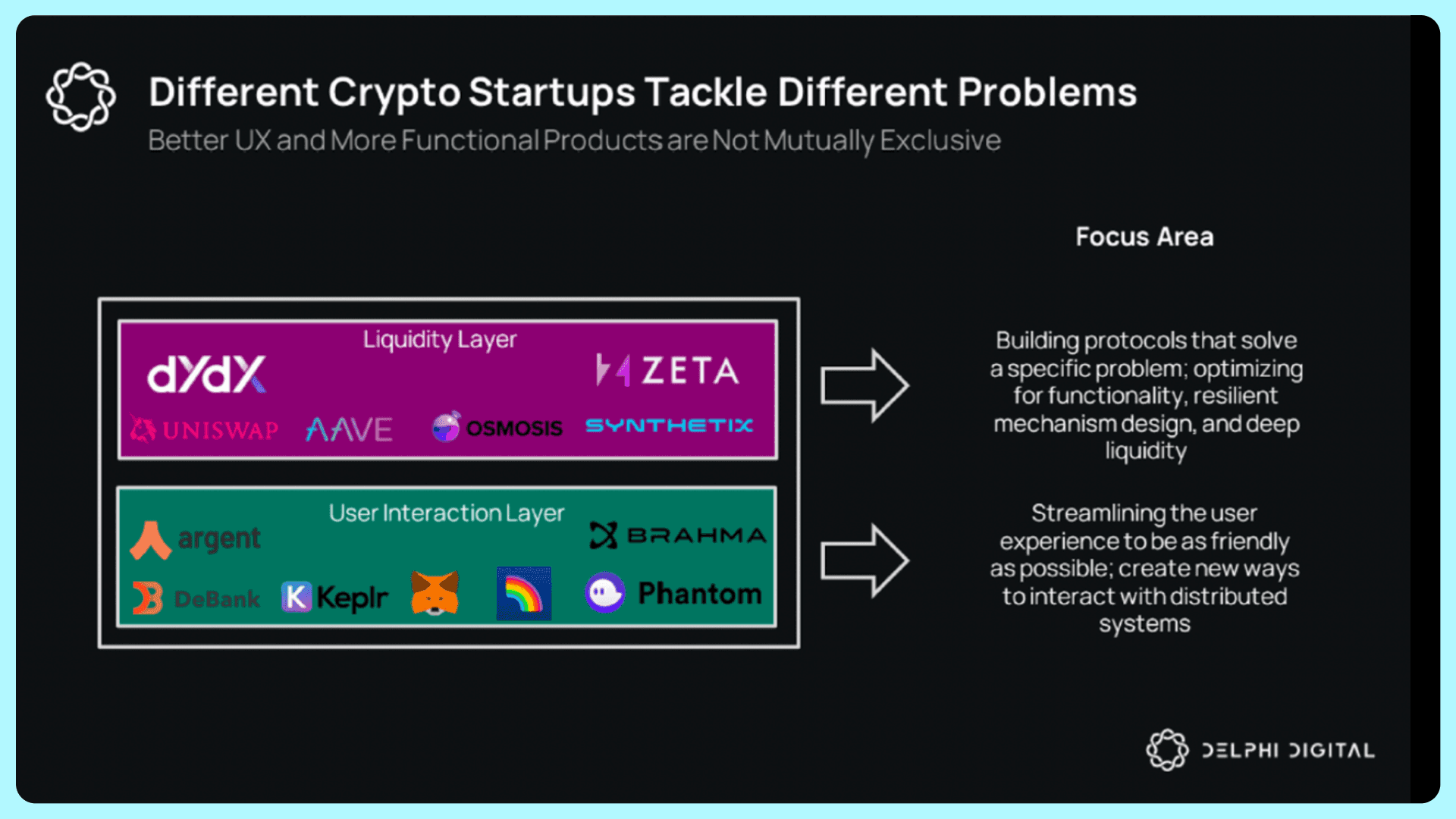

While the DeFi landscape evolves, the tools that support investors don’t always keep up with the necessities of users.

While allowing investors to operate on-chain was enough in the previous cycle, the next step will be streamlining the user experience.

For this reason, tools like Console can support users in dealing with these new challenges, improving the flows and efficiency of institutional investors operating on-chain and creating new ways to interact with dApps and blockchains.

Operating on-chain for institutional investors means, among other things, selecting the right custody partner and simplifying the way they can operate on-chain from a multi-sig.

Asset managers looking to allocate funds in DeFi can refer to our last article: An Asset Manager’s Guide to On-chain Asset Allocation.

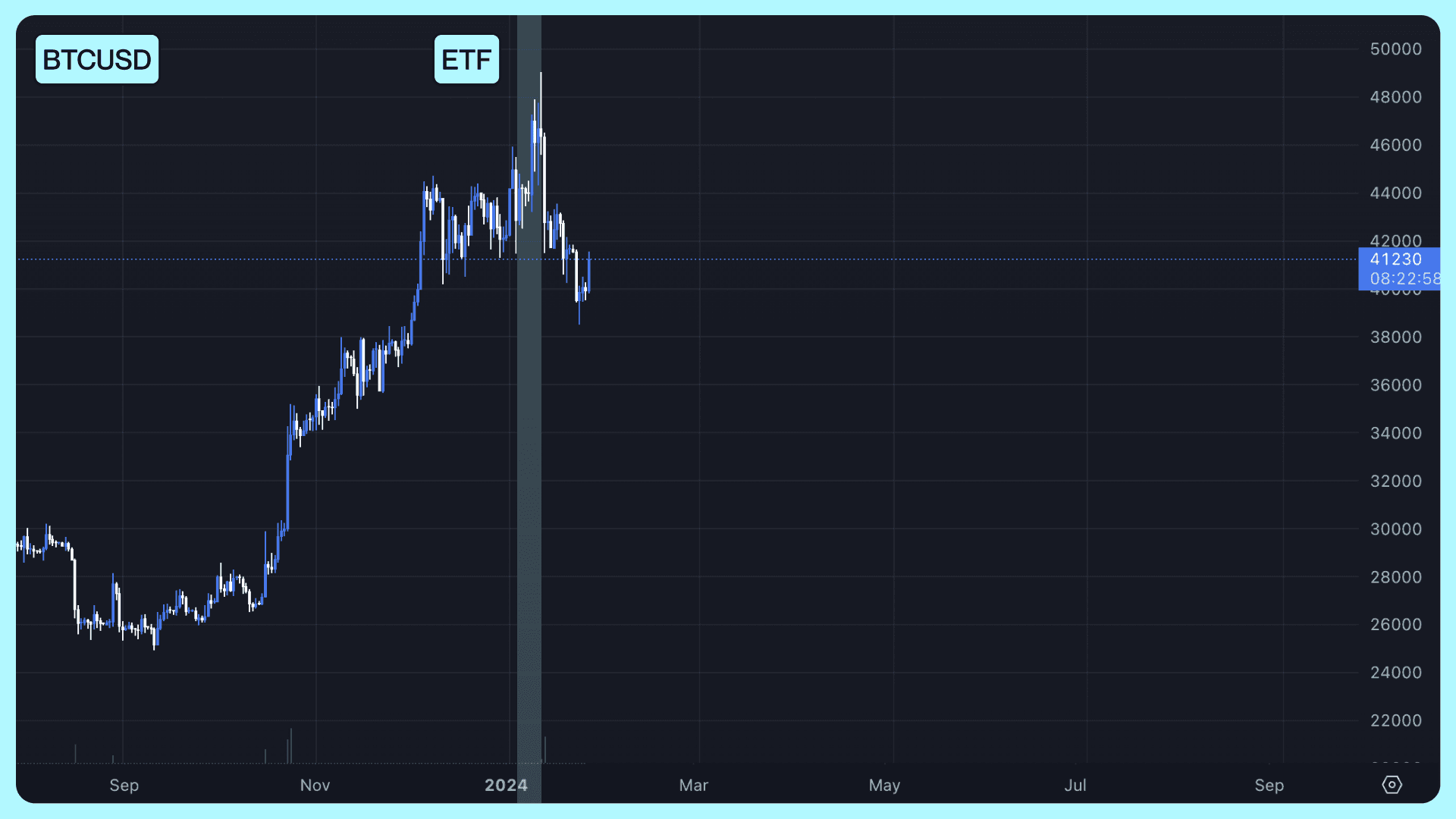

Furthermore, with the launch of the Bitcoin ETF, the lines between TradFi and DeFi are more blurred. This is also reflected in more entanglement and cross(yield)-pollination.

For instance, with traditional yields still low during the economic cycle, DeFi platforms are seeing renewed interest in yield farming and other passive income strategies.

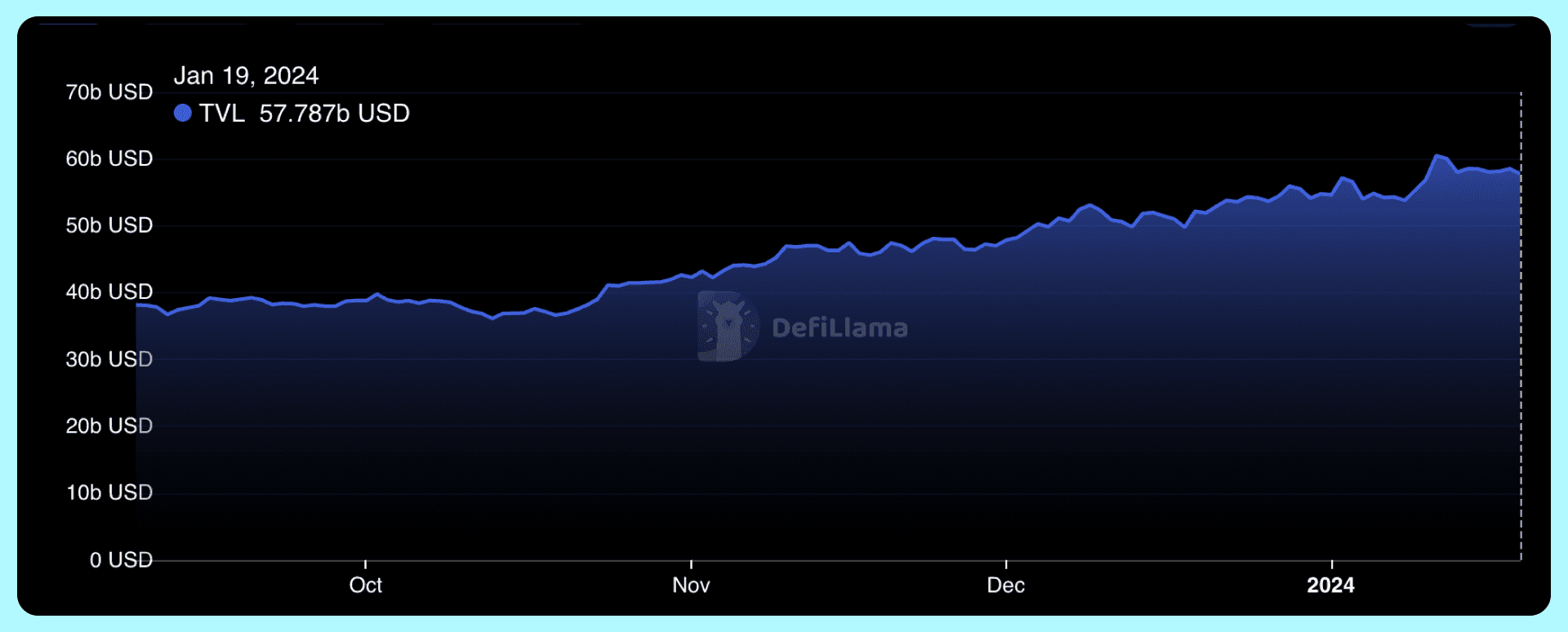

Within these interesting market movements, January has seen a general rise in prices and activity in DeFi, with Total Value Locked (TVL) rising to $57b, almost a 10% increase from $54b on the 31st of December 2023.

However, chasing yields is not easy, especially across multiple blockchain networks.

For this reason, at Brahma, we are gearing up for the launch of automation, which will allow investors to improve the efficiency of their portfolio allocation and rebalancing without requiring active management.

Brahma will allow investors to automatically rebalance positions based on on-chain and off-chain triggers and execute transactions in batches, saving time and costs.

As part of our roadmap, we have just launched our AAVE lending Automations, live on Console now.

These strategies gain particular importance when we contextualize them in a cross-chain world, where Layer 2 (L2s) scaling solutions are increasingly integrated into DeFi protocols to address transaction fees and network congestion concerns of the mainnet.

This is also why Brahma keeps an open eye on the most thriving DeFi ecosystems where we can provide the most value. To fully unlock our value proposition and deliver on our promise, we have just launched on Arbitrum, with plans to expand on more L2.

Moving away from Ethereum mainnet greatly increases the realm of what’s possible to carry out on top of Console, thus impacting users who carry out frequent operations on-chain.

Read more on this on our blog about our Arbitrum launch. It does not matter whether you are a degen, a DAO, a protocol, or a fund, Console has a solution for you. Leverage the power of Sub-Accounts, Policies, and Automation to redefine and improve your workflows.

Test the power of Console for yourself or your team, DM our team to schedule a demo, or apply for early access here: brahma.fi.