Brahma goes Multi-chain: Console is now Live on Arbitrum

Jan 11, 2024

~ 4 mins

We are extremely proud to announce that Console is now multi-chain, with future expansion plans to provide frictionless cross-chain operations.

Console is live on Arbitrum, and is ready to serve on-chain degens, protocols, DAOs, and funds.

Initially, Console will be open for previous users of our vaults and OG community members, who are being whitelisted to experience the power of Console on Arbitrum.

We will then gradually grant access to our product to more whitelisted users.

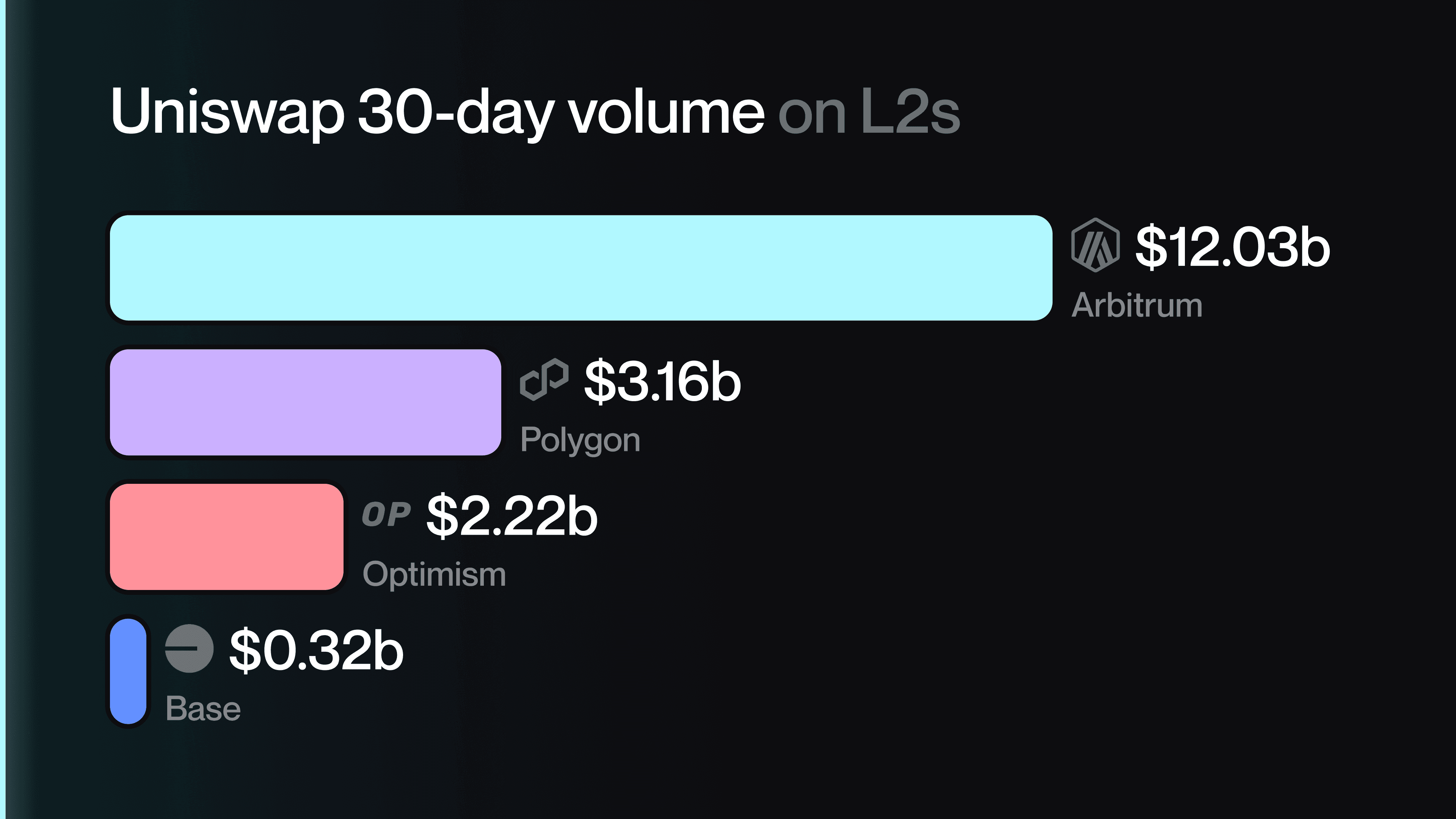

Why Arbitrum?

Arbitrum stands out in the Ethereum ecosystem, with over $2.4b in TVL and 500+ live protocols.

Arbitrum’s DeFi ecosystem is highly interconnected, with yield-bearing assets being seamlessly composable across several protocols.

Console can support users as they navigate through this entangled landscape, empowering their DeFi operations through the use of automations or batched routines.

As DeFi gets increasingly complex, users interact with multiple protocols to manage their positions, a time-consuming process prone to errors.

Console makes these routines repeatable, automatable, and scalable.

Arbitrum is also renowned for its diverse mix of users, including sophisticated degens and on-chain native funds. To cater to this audience, Console’s expansion goes beyond DeFi operations, as it paves the way for more inclusive and secure access to asset management, governance, and operations.

In fact, among others, Arbitrum is fertile ground for DAOs and has a very active community involved in decentralised governance. Operations such as voting, DAO compensation, and other forms of governance are now more feasible and efficient, thanks to Console.

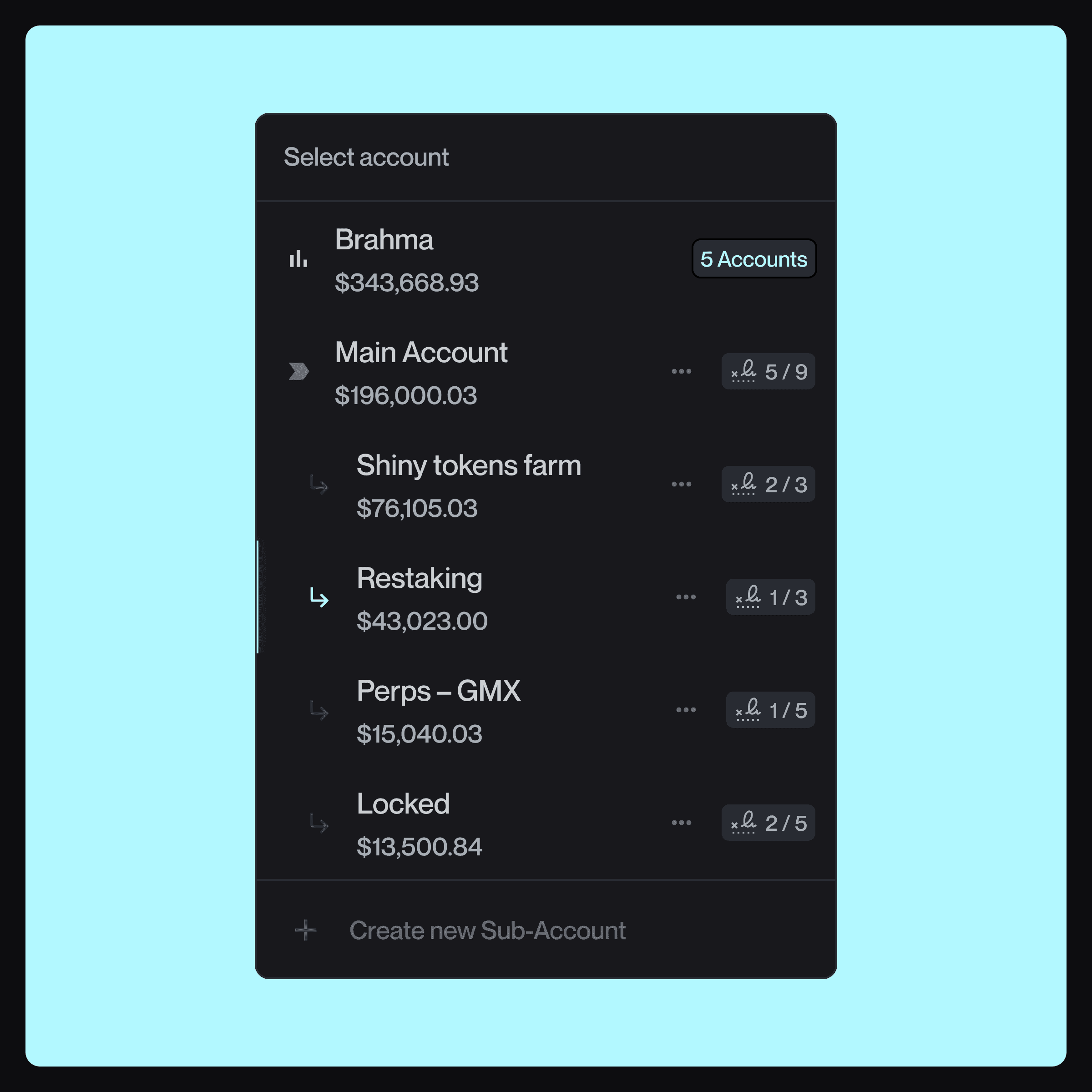

Among those, DAOs can automate their internal operations, as well as carry out voting operations without requiring multiple signatures at all times, thanks to Console Sub-Accounts.

Here’s how Console’s expansion to Arbitrum can help empower users

Sub-Accounts + Policies: Improved security through clear risk segregation across different Sub-accounts, from yield farming to trying protocols/farming points without getting rugged.

Creation of Sub-Accounts to delegate tasks with granular access control to which protocols, assets, and interactions Sub-Accounts can carry out, making the process trustless

Improved participation in Governance, with dedicated Sub-Accounts that do not require multiple signatures for each on-chain vote.

Improved DAO management with automated payroll, and operations management.

Arbitrum booms with innovations and new primitives, and introducing best practices of risk segregation helps users improve their portfolio management.

Additionally, policies allow users to layer security effectively, leaving some Sub-Accounts more open for experimentation, while others more restricted, where their scope is meant to be very specific.

The integration of Arbitrum at this point is instrumental to the upcoming launch of Lending Automations, our Batched Execution, as well as further automations.

Automations will complement sub-accounts through automated routines

Imagine a sub-account farming that automatically claims yield and auto-compounds it or swaps it for another token and uses it for borrowing.

The possibilities are endless.

We are already at work with selected Arbitrum protocols who have been extremely helpful in testing Console and helping us iterate leading to this launch.

We invite the broader Arbitrum community to join us in this exciting new chapter.Experience the enhanced capabilities of Brahma Console on Arbitrum.

Beyond DeFi

Operating from the Ethereum mainnet often means weighing the cost-benefit of on-chain operations due to prohibitive gas costs.

This limitation creates a barrier to entry for smaller players and is especially pronounced in non-financial transactions, with operations such as microtransactions, voting, or active portfolio management that may be restricted or completely delegated off-chain, due to their expensive computational cost.

We aim to simplify the way users interact with DeFi, to establish an even playing field where optimal on-chain execution is not only restricted to institutional investors.

Our Arbitrum launch will empower users to leverage the power of Console to improve their asset management, governance, or operations, which were previously too expensive to carry out on-chain on mainnet.