Morpho Yield Optimizer: Precision Automation for Maximum Returns

Oct 5, 2024

3 mins

The Automation sprint is just kicking off on Brahma Accounts!

Introducing the Morpho Yield Optimizer, powered by the Brahma Builder Kit, built to eliminate the complexity of chasing onchain yields.

Designed for efficiency, this strategy operates across Morpho Earn vaults on Base or Ethereum, continuously monitoring available vaults to rebalance funds with precision. Instead of manually managing deposits and tracking APY volatility, the Morpho Yield Optimizer ensures that every rebalance decision factors in both yield and liquidity, giving you an edge in maximising your yield onchain. As for Brahma Rewards, all Morpho automation users will enjoy a 1.5x weekly KARMA booster to maximize their earnings. This booster scales with deposits, so don't hold back, go big for greater rewards.

Optimised for liquidity checks, gas-efficient transactions, and automated rebalancing, the Morpho Yield Optimizer helps you extract maximum yield seamlessly. With every action running through your smart wallet, you maintain full control over your funds, while automation handles the heavy lifting—ensuring top-tier performance with zero compromises.

Supported Assets:

- On Base: USDC, WETH

- On Mainnet: USDC, WETH, USDC, WBTC

Suggested minimum amount to subscribe to the automation:

Base: $100 worth of the selected token

Mainnet: $25k worth of the selected token and $50k for bi-weekly rebalance frequency

These amounts are carefully calculated to cover the gas costs involved in operating the automation, accounting for both best- and worst-case gas scenarios. This ensures that each rebalance is profitable, allowing your automation to consistently generate additional yield even after covering transaction expenses.

The Automation, In Action.

The Morpho Yield Optimizer simplifies your yield strategy through seamless automation:

Choose your input asset.

Set your rebalancing frequency:

Weekly

Bi-weekly

Monthly

Once configured, the optimizer tracks all relevant vaults and automatically suggests the highest-yielding vault. However, yield opportunities evolve quickly. If conditions shift during execution, the automation shifts to allocate funds accordingly. The optimizer ensures that deposits are only made into vaults with enough collateral to guarantee smooth withdrawals.

It also offers a straightforward exit mechanism:

Active Positions:

Withdraw funds from the current vault.

Transfer assets back to your main account.

Deregister the automation runner from the subaccount.

Pending Positions:

Transfer funds directly to the main account.

Deregister the automation runner without delay.

This frictionless exit ensures that you retain full control over your assets at any time.

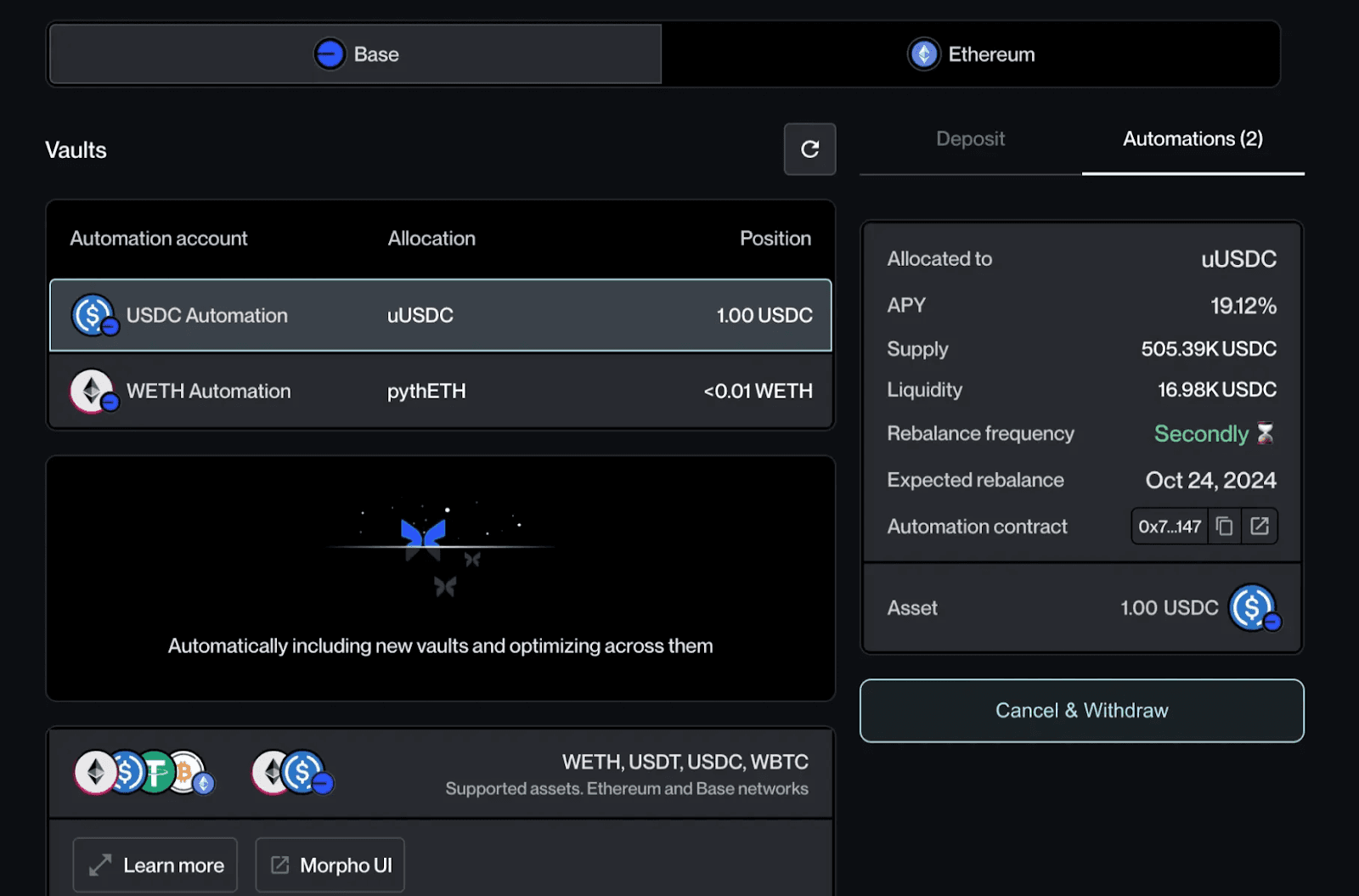

Users can track the status of their funds via a clean, intuitive interface:

Current Vault: Displays where funds are currently allocated.

Net APY & Balance: Real-time performance metrics.

Pending Allocation: If not yet deployed, the UI indicates that funds will be allocated shortly to the top-performing vault.

Catch the full tutorial here.

Precision Rebalancing at Every Interval

At each scheduled interval, the strategy executes a sophisticated rebalancing process:

Scan available Morpho Earn vaults for the selected asset.

Calculate net APY (including any rewards).

Identify the highest-yielding vault.

If needed, withdraw from the current vault.

Deposit into the new top-performing vault.

This ensures that your funds remain agile, ready to capture shifting yield opportunities without unnecessary manual intervention.

Fees

Execution Fees: Applied on deposits and rebalances to cover gas costs. These are estimated based on the chain’s current gas price and may vary.

Performance Fees: Waived until 30/11/2024. From 1/12/2024, a 5% fee on earned yield will apply, charged only during rebalances (never on your initial deposits).

In the next phase, users will have the option to select from a list of Morpho vaults for rebalancing.

Learn more, dive deeper into docs here.

For the latest updates, join our Telegram Channel, and follow us on Discord and Twitter.